Credit Layer for Intents: Sprinter

I met Greg when we started Clave (it was called Opclave back then). He’s an exceptional builder who has contributed to several critical infrastructures in crypto, including the Ethereum 2.0 project and beyond. Now, he and his team are building a new credit layer for solvers, and I’m excited to support them with a small angel investment.

Why Intent Systems Can’t Scale to Trillions

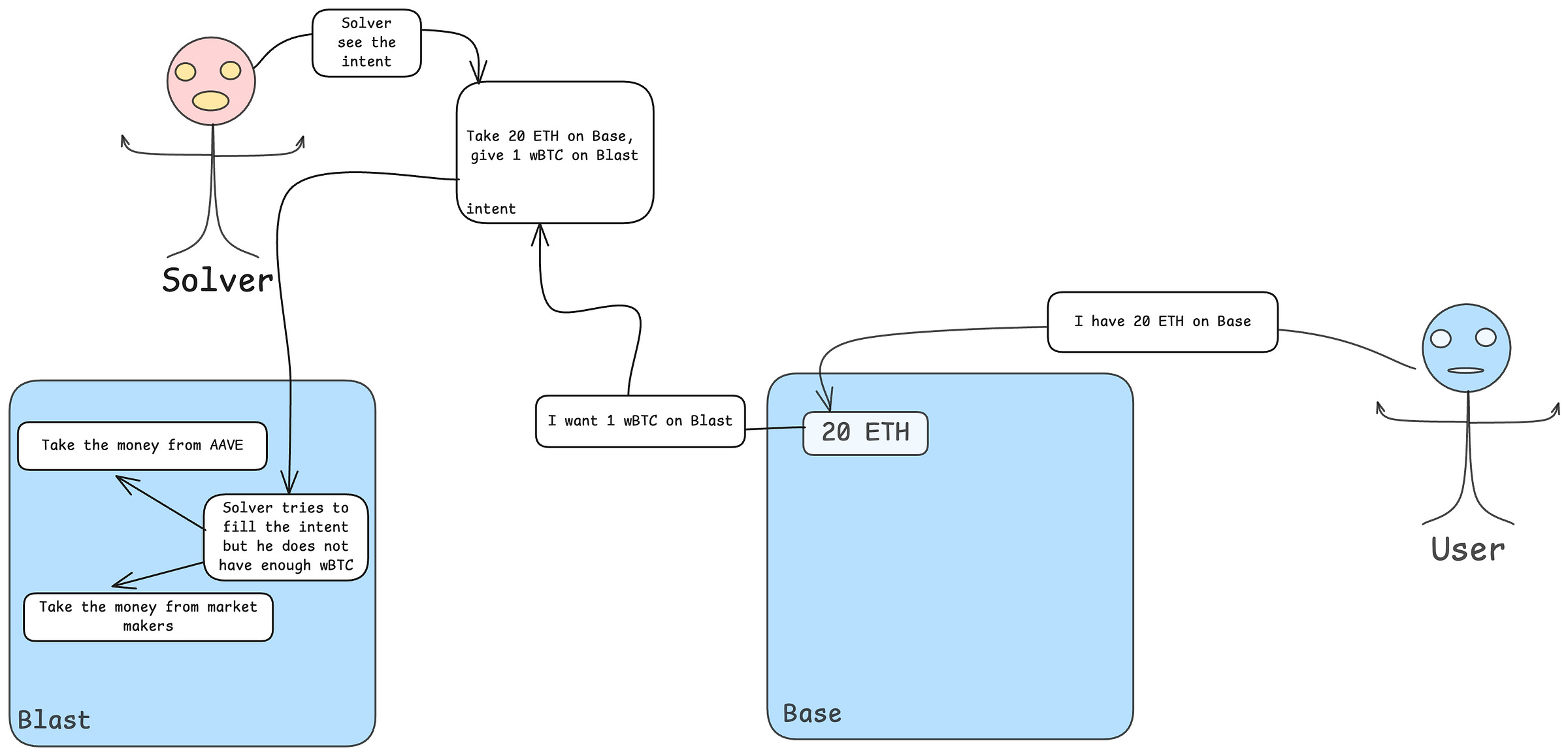

Currently, almost all intent systems rely on private liquidity; that is, individuals or entities with large amounts of capital. This creates a major bottleneck for intent-based bridging systems, as it requires a small group of well-capitalized players to continuously support transactions and projects.

In contrast, traditional Web3 markets thrive on open liquidity models where anyone can provide or access funds permissionlessly. However, this openness hasn’t yet translated to intent systems, except in a few protocol-specific implementations.

The Solution: Sprinter

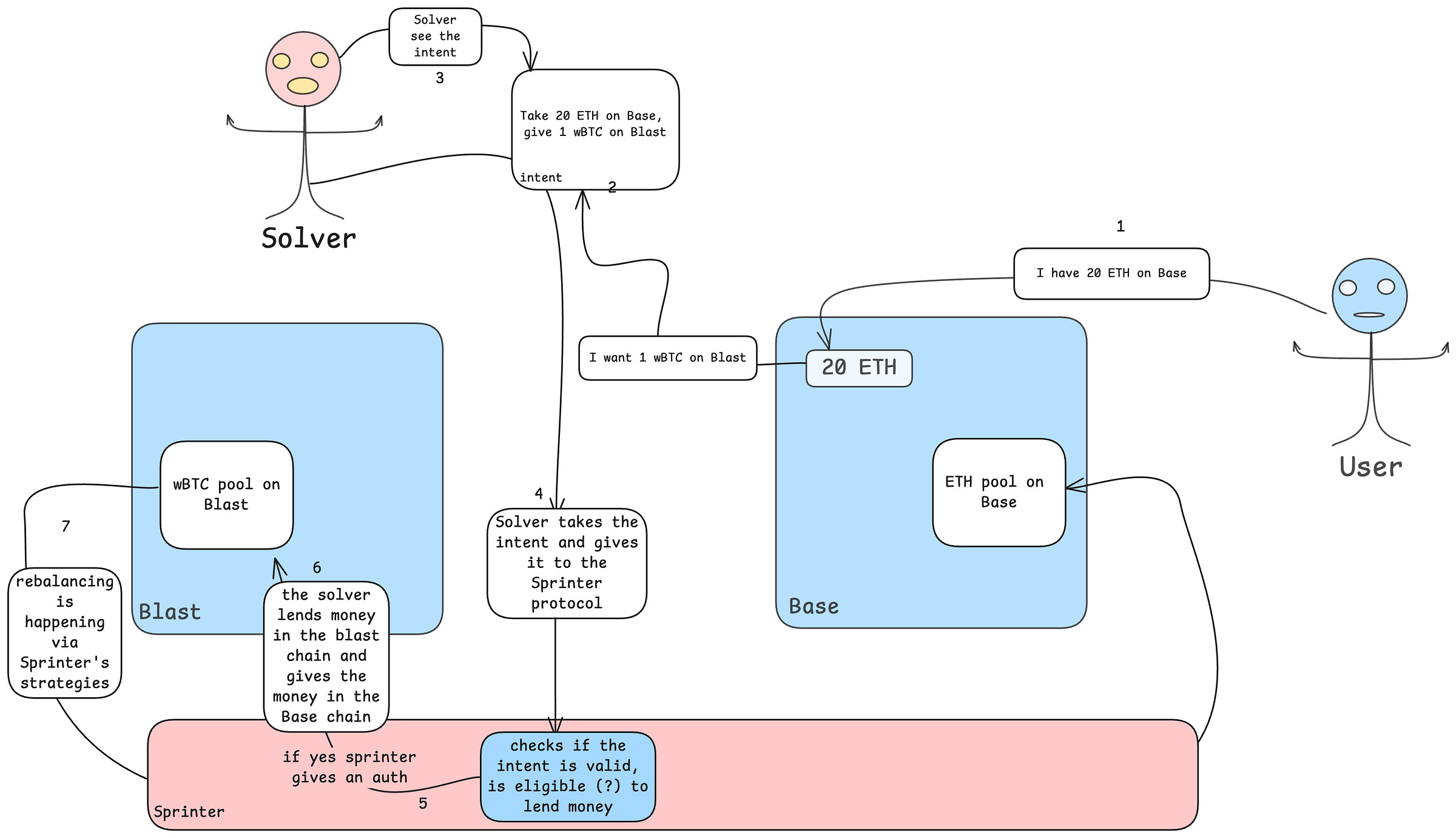

Sprinter is solving this structural limitation. The protocol enables anyone to act as a solver without needing their own liquidity. It introduces a model where liquidity providers (LPs) deposit funds into a pool, and solvers can borrow from that pool when certain conditions are met. This design connects LPs seeking yield with solvers who need capital to execute intents, unlocking scalability and composability for the entire intent ecosystem.

As a result, I expect Sprinter to evolve into a credit layer for crypto that is chain-, ecosystem-, and protocol-agnostic. By enabling capital-efficient access to liquidity, Sprinter introduces a new yield primitive — cross-chain yield — while significantly simplifying the work for solvers.

The Moat for Sprinter

Almost all solver-based intent protocols end up with just a few dominant solvers, usually two or three, that no one else can come close to competing with. This happens for a simple reason: intent-based protocols need to bootstrap liquidity, and the initial LPs (or solvers) naturally gain market share as they process more flows. More flow leads to better execution results, creating a self-reinforcing advantage; a classic chicken-and-egg problem, but one that forms a powerful moat for early solvers.

As solvers turn to Sprinter for cheaper liquidity, the protocol will attract more order flow. This in turn means Sprinter-based solvers will consistently deliver better execution quality for intents. Over time, this feedback loop will strengthen Sprinter’s position, potentially making it unbeatable if it captures the early order flows of next-generation intent protocols.

If you’re building an intent protocol or launching a new chain that needs to bootstrap liquidity for their intent protocol, you should definitely connect with the Sprinter team.

https://sprinter.tech/